Choose risk-first compliance that’s always on, built for you.

Go back to blogs

Mastering risk: How to score external and internal risks

Last updated on

August 9, 2024

14

min. read

Accurate and up-to-date risk scoring is a key component of any successful enterprise risk management system. As key indicators of any Enterprise Risk Management System, risk scores can help you identify and respond to the most pressing concerns affecting the health of your organization.

Risk scores provide a quantifiable measure of potential threats, enabling organizations to make informed decisions and prioritize their risk mitigation efforts. Whether dealing with internal challenges like human error and organizational inefficiencies or external threats such as economic downturns and cyber attacks, understanding your risk landscape is essential for safeguarding your business.

In this blog post, we’ll explore the intricacies of internal and external risk scores, delve into the methodologies for determining these scores, and highlight their importance in maintaining a resilient and thriving organization.

Understanding risk scores

Risk scores are quantifiable measures that allow organizations to assess the potential impact of various risks. They are crucial for identifying and responding to both internal and external threats, ultimately supporting your company’s growth, reducing inefficiencies, and preventing reputational damage.

Risk scores are numerical values assigned to risks based on their likelihood and potential impact on an organization. They provide a standardized way to quantify and prioritize risks, allowing organizations to allocate resources effectively and focus on mitigating the most significant threats.

Why internal and external risk scores matter?

Both internal and external risk scores are vital for a comprehensive risk management strategy. Together, they provide a full picture of the potential threats facing an organization, allowing for more informed decision-making and strategic planning.

Effective risk scoring helps organizations to not only identify and respond to immediate threats but also to anticipate and prepare for future challenges. This proactive approach to risk management supports organizational resilience and long-term success.

Accurate and up-to-date risk scores play a critical role in effective risk management and decision-making within an organization. Here are some key reasons why risk scores are important:

- Prioritization: Risk scores help prioritize risks based on their potential impact, allowing organizations to focus resources on addressing the most critical threats first.

- Resource allocation: By quantifying risks, organizations can allocate resources more efficiently, directing investments towards areas with the highest risk exposure.

- Decision support: Risk scores provide decision-makers with actionable insights into the potential consequences of different courses of action, enabling them to make informed decisions that align with the organization’s risk appetite and strategic objectives.

- Performance monitoring: Regular monitoring and updating of risk scores allow organizations to track changes in risk levels over time and assess the effectiveness of risk mitigation efforts.

- Communication: Risk scores serve as a common language for communicating risk-related information across the organization, facilitating collaboration and alignment among stakeholders.

- Compliance: Many regulatory frameworks and standards require organizations to assess and manage risks systematically. Risk scores help demonstrate compliance with these requirements by providing evidence of risk assessment and mitigation activities.

Risk scores are essential tools for identifying, assessing, and managing risks in organizations. By quantifying risks and their potential impact, organizations can proactively mitigate threats, protect assets, and maximize opportunities for success.

What are internal risk scores?

Internal risk scores are assessments of any risk factor that originates within the company. Though they can be just as damaging as external risks, internal risks are often the most difficult to identify because they heavily rely on the company’s culture of risk awareness and reporting.

Understanding internal risk scores

Internal risks can arise from various sources within the organization, including human error, inadequate organizational structures, and asset loss. Mid-level management is often more aware of potential internal risks, but they frequently struggle to secure the necessary support from upper management to put adequate mitigation processes in place.

By regularly assessing and addressing these internal risks, organizations can create a more resilient and prepared internal environment.

What are external risk scores?

External risk scores evaluate threats that come from outside the company. These risks can vary greatly in nature and often have few, if any, warning signs. Identifying potential external risks is crucial so that your organization has processes in place to react and mitigate damage as soon as possible.

External risks are typically beyond the control of the organization but can have a significant impact on operations, finances, and reputation. These risks range from natural disasters to economic changes and political factors.

By understanding and preparing for these external risks, organizations can develop robust response strategies that minimize their impact.

How to determine a risk score?

Determining a risk score involves a systematic approach that includes risk identification, risk analysis, and calculation of the risk score. Each of these steps is critical to ensuring that the risk scores accurately reflect the potential threats to your organization.

1. Identify risks

Risk identification is the foundation of an effective risk management process. It involves recognizing potential threats that could negatively impact your organization. Here are the key steps in identifying risks:

- Initial assessment: Begin by brainstorming potential risks with your team. This should include obvious risks as well as more nuanced ones.

- Consult stakeholders: Involve various stakeholders from different departments to gather diverse perspectives on potential risks.

- Review historical data: Analyze past incidents and issues to identify recurring risks.

- Use risk checklists: Utilize industry-standard risk checklists to ensure no common risks are overlooked.

- Regular reassessment: Make risk identification a continuous process by regularly reassessing risks throughout the project life cycle.

2. Run a risk analysis

Once risks are identified, the next step is to analyze their potential impact and likelihood. This involves both qualitative and quantitative assessments.

- Qualitative analysis: Evaluate the severity and consequences of each identified risk. This involves discussions with stakeholders to understand the potential impact on operations, finances, and reputation.

- Quantitative analysis: Assign numerical values to the likelihood and impact of each risk. This can involve statistical models and historical data analysis to estimate probabilities and potential losses.

- Scenario analysis: Develop different scenarios to understand how various factors might influence the impact and likelihood of risks. This helps in understanding the full spectrum of potential outcomes.

3. Calculate risk score

The risk score is a quantifiable measure that combines the impact and likelihood of a risk. There are typically three different formulas used to calculate a risk score, each applied in slightly different contexts depending on the organization’s specific needs and the nature of the risks being evaluated. These formulas include:

Risk Score = Likelihood × Impact

Risk Score = Probability of Event × Magnitude of Loss

Risk Score = Likelihood × Severity × Detection (used in FMEA – Failure Mode and Effects Analysis)

The choice of formula depends on the context and the specific aspects of risk that are most relevant to the organization or industry:

When are each of these formulas used and by whom?

1. Risk Score = Likelihood × Impact

When used: This is the most common and straightforward method used across various industries for general risk assessments. It’s applicable in project management, operational risk management, information security, and other areas where risks are evaluated based on how likely they are to occur and the potential impact they would have if they did occur.

Example: An information security risk where the likelihood of a data breach is medium and the impact is high.

Steps to calculate:

- Determine the probability of the risk event occurring: This is often rated on a scale, for example—Very Low (1), Low (2), Medium (3), High (4), Very High (5).

- Assess impact: Determine the potential impact or consequence of the risk event. This is also rated on a scale, for example—Insignificant (1), Minor (2), Moderate (3), Major (4), Catastrophic (5)

- Calculate risk score: Multiply the Likelihood by the Impact.

2. Risk Score = Probability of Event × Magnitude of Loss

When used: This formula is often used in financial risk management and insurance. It’s applied when risks need to be evaluated based on the statistical probability of an event occurring and the expected financial loss if the event happens.

Example: Assessing the risk of natural disasters (like floods) for insurance purposes where the probability of the event (flood) is assessed and multiplied by the expected financial loss (damage to property).

Steps to calculate:

- Determine probability of event: Estimate the probability of the event occurring, usually expressed as a percentage or decimal.

- Estimate magnitude of loss: Assess the potential financial loss or other measurable impact if the event occurs.

- Calculate risk score: Multiply the Probability by the Magnitude of Loss.

3. Risk Score = Likelihood × Severity × Detection (FMEA)

When used: This formula is specific to Failure Mode and Effects Analysis (FMEA), a systematic method for evaluating processes to identify where and how they might fail and assessing the relative impact of different failures. It’s commonly used in engineering, manufacturing, and healthcare industries.

Example: Evaluating the risk of a mechanical failure in a manufacturing process where the likelihood of failure, the severity of the potential failure, and the ability to detect the failure before it occurs are all considered.

Steps to calculate:

- Assess likelihood: Determine how often the failure is likely to occur. This is rated on a scale (e.g., 1 to 10).

- Assess severity: Determine the severity of the failure’s impact. This is rated on a scale (e.g., 1 to 10).

- Assess detection: Determine how likely the failure is to be detected before it occurs. This is rated on a scale (e.g., 1 to 10), where a lower number indicates better detection.

- Calculate risk score: Multiply the Likelihood by the Severity and Detection ratings.

Best practices for maintaining accurate risk scores

Maintaining accurate risk scores is crucial for effective risk management. Here are some best practices to ensure your risk scores remain relevant and reliable.

Regular updates

- Frequent reviews: Conduct regular reviews of all identified risks and their scores. This helps in keeping the risk data current and reflective of the latest business environment.

- Update data sources: Ensure that the data sources used for risk analysis are up-to-date. This includes financial reports, market analyses, and other relevant information.

- Adjust for changes: modify risk scores as new information becomes available or as the business environment changes. This ensures that risk scores accurately reflect current realities.

Continuous monitoring

- Automated tools: Use automated risk management tools to continuously monitor risk factors. These tools can provide real-time updates and alerts on changing risk conditions.

- Key Risk Indicators (KRIs): Develop and monitor KRIs to get early warnings of potential risks. KRIs are metrics that signal increasing risk levels, allowing for proactive management.

- Regular audits: Conduct regular audits to verify the accuracy of risk scores and the effectiveness of risk management processes.

Engagement across the organization

- Cross-functional collaboration: Engage various departments in the risk management process. Different perspectives can help in identifying and assessing risks more comprehensively.

- Risk awareness training: Provide training to employees at all levels to increase awareness and understanding of risk management practices. This helps in creating a risk-conscious culture.

- Leadership involvement: Ensure that top management is actively involved in the risk management process. Their support is crucial for securing resources and implementing risk mitigation strategies.

By following these best practices, organizations can maintain accurate and effective risk scores, ultimately supporting better decision-making and enhancing overall resilience.

Importance of knowing your risk score

Accurate and up-to-date risk scores are crucial for effective risk management. They help organizations identify and prioritize potential threats, enabling proactive measures to mitigate negative impacts.

Here’s why understanding your risk score is so important:

- Informed decision-making: Risk scores provide a quantifiable measure of potential threats, aiding in strategic decision-making.

- Resource allocation: Helps prioritize risks and allocate resources efficiently to address the most critical issues.

- Proactive management: Enables organizations to anticipate and prepare for risks, reducing the likelihood of adverse events.

- Regulatory compliance: Ensures adherence to industry standards and regulatory requirements, avoiding penalties and reputational damage.

- Business continuity: Supports the development of robust business continuity plans by identifying key vulnerabilities.

Designing a risk-response system

A well-designed risk-response system is essential for managing risks effectively. It involves creating a structured approach to identify, assess, respond to, and monitor risks.

- Risk identification: Continuously identify potential risks through regular assessments and stakeholder consultations.

- Risk analysis: Analyze the potential impact and likelihood of each identified risk to prioritize response efforts.

- Mitigation strategies: Develop and implement strategies to reduce the likelihood and impact of risks. This includes preventive measures, contingency plans, and risk transfer mechanisms like insurance.

- Response plans: Create detailed response plans for high-priority risks. These plans should outline the steps to be taken if a risk materializes, including roles, responsibilities, and communication protocols.

- Monitoring and review: Regularly monitor risks and review the effectiveness of mitigation strategies. Adjust plans as necessary to respond to changing conditions.

Going deeper with Key Risk Indicators (KRIs)

KRIs are metrics used to monitor and predict potential risks. They are based on data that indicates changes in risk levels. KRIs help organizations anticipate risks, improve risk awareness, and enhance decision-making. They act as early warning systems, enabling timely interventions.

How KRIs work

- Selection: Choose relevant KRIs based on industry standards, historical data, and specific business needs. Effective KRIs should be measurable, predictive, and actionable.

- Monitoring: Regularly track KRIs to identify trends and changes in risk levels. Use automated tools for real-time monitoring and alerts.

- Analysis: Analyze KRI data to understand the underlying causes of risk changes. This helps in identifying emerging threats and developing appropriate responses.

- Reporting: Communicate KRI findings to stakeholders, including top management, to ensure awareness and support for risk management initiatives.

- Action triggers: Define thresholds for each KRI that, when crossed, trigger specific actions. This ensures a swift and coordinated response to emerging risks.

Tying risk to financial impact with risk quantification

Risk quantification involves calculating the potential loss frequency and severity of a particular risk and translating it into financial terms.

By quantifying risks, organizations can make more informed decisions about where to invest in mitigation efforts. It provides a clear understanding of the potential financial impact, making it easier to justify risk management expenditures to stakeholders.

The FAIR model and Monte Carlo simulations

- The FAIR model: The Factor Analysis of Information Risk (FAIR) model is a structured approach to quantifying risk. It involves identifying and analyzing the factors that contribute to risk and estimating their potential financial impact.

- Monte Carlo simulations: Monte Carlo simulations are used to model the probability of different outcomes based on random sampling. In risk quantification, these simulations help estimate the range of potential financial impacts by running thousands of scenarios.

- Loss exceedance curve: Monte Carlo simulations produce a loss exceedance curve, showing the percentage of simulations that meet or exceed a given amount of loss within a specified period.

- Frequency and magnitude table: The simulations also generate a table indicating the probable frequencies and magnitudes of loss events, helping organizations understand the likelihood and potential severity of different risks.

By understanding and implementing these concepts, organizations can develop a comprehensive approach to risk management that not only identifies and assesses risks but also quantifies their financial impact, allowing for more strategic and informed decision-making.

Conclusion

Accurately determining external and internal risk scores is essential for effective risk management. By identifying, analyzing, and scoring risks, organizations can design robust response systems, mitigate threats, and support growth. Proper risk scoring enables proactive risk management, ensuring smooth operations and protection against disruptions.

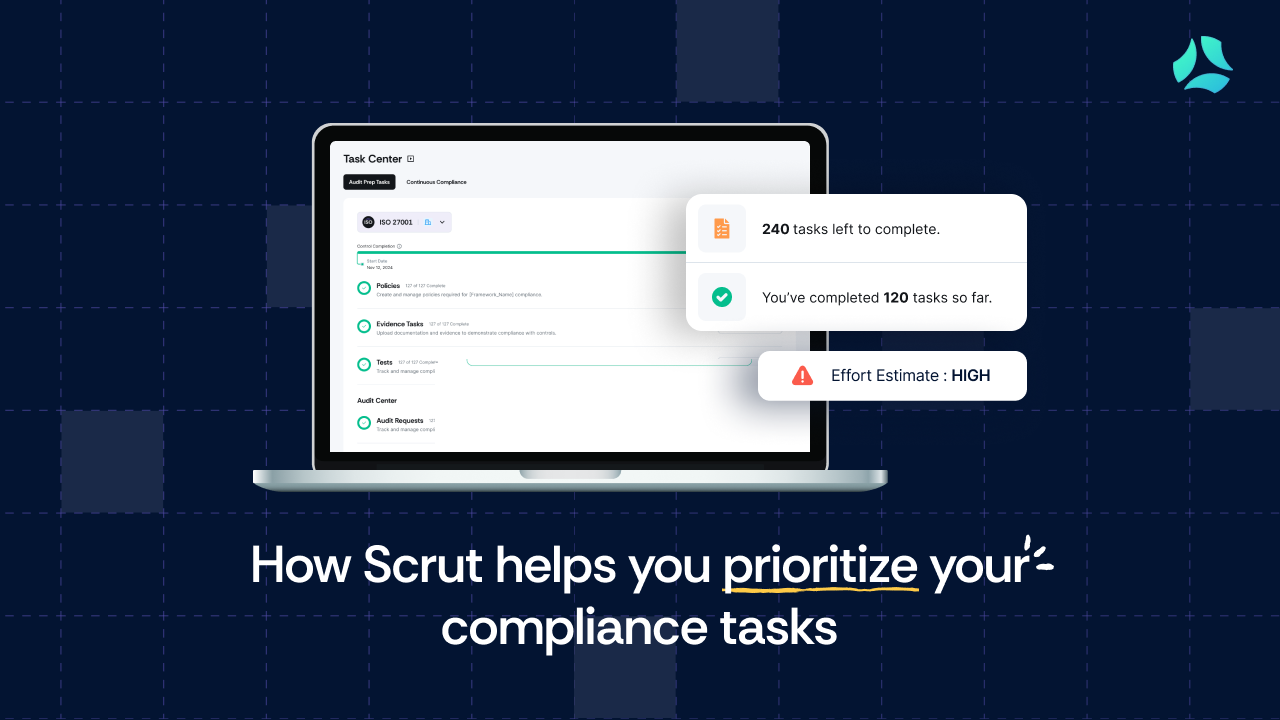

At Scrut, we help organizations enhance their risk management processes with our expert tools and guidance. Contact us today to streamline your risk assessment and build a resilient framework. Partner with Scrut for a secure and successful future.

Frequently Asked Questions

1. What is the difference between external and internal risk scores?

External risk scores assess threats originating outside the organization, such as cyberattacks or market fluctuations, while internal risk scores evaluate risks within the organization, like operational failures or employee misconduct.

2. How do I identify key factors affecting external risk scores?

Key factors for external risk scores include market trends, regulatory changes, cyber threat landscapes, and geopolitical events. Regularly monitoring these areas helps in accurately assessing external risks.

3. What methodologies can be used to determine internal risk scores?

Common methodologies for internal risk scoring include risk assessments, internal audits, employee surveys, and historical data analysis. Tools like risk matrices and heat maps are also useful for visualizing internal risks.

4. How frequently should risk scores be updated?

Risk scores should be updated regularly, typically on a quarterly basis, or whenever significant changes occur in the external environment or internal operations. Continuous monitoring ensures that risk scores remain accurate and relevant.

5. What tools and software are available for assessing risk scores?

Various tools and software are available for assessing risk scores, including risk management platforms like RSA Archer, LogicGate, and RiskWatch. These tools help streamline the process of identifying, analyzing, and mitigating risks.

Table of contents