Building Business Resilience: The Role of Integrated Risk Management (IRM)

In an ever-changing and unpredictable business landscape, resilience has become a key attribute for any successful organization. The ability to adapt, withstand, and recover from various challenges is paramount. One of the critical pillars supporting business resilience is Integrated Risk Management (IRM).

Integrated risk management is not a new concept, but its significance has grown exponentially in recent years as businesses face an array of risks, from cybersecurity threats to global economic fluctuations.

This comprehensive approach to risk management goes beyond traditional risk assessment and response strategies. It seamlessly integrates risk considerations into the broader business strategy, aligning objectives and enhancing decision-making processes.

In this blog, we will delve into the essential role of Integrated risk management in building business resilience and ensuring long-term sustainability. We will explore the core principles of Integrated risk management, its components, and practical strategies for implementation.

Definition and principles of integrated risk management

Integrated Risk Management (IRM) is a comprehensive approach that organizations adopt to identify, assess, manage, and mitigate risks across various facets of their operations. It involves integrating risk management procedures into the core of the organization's decision-making processes, strategies, and activities.

integrated risk management encompasses several key principles and concepts:

- Proactive risk management: IRM focuses on proactively identifying and addressing risks rather than reacting to them after they occur. It promotes a forward-thinking approach to risk mitigation.

- Holistic approach: Integrated risk management considers all types of risks, including financial, operational, strategic, compliance, and cybersecurity risks.

- Risk awareness: Integrated risk management fosters a risk-aware culture within the organization. It encourages employees at all levels to understand and manage risks relevant to their roles.

- Data-driven decision-making: IRM relies on data and analytics to assess and prioritize risks. It enables organizations to make informed decisions based on a deep understanding of their risk landscape.

- Integration with business strategy: Integrated risk management aligns risk management with the organization's broader business strategy. It ensures that risk considerations are integrated into strategic planning and execution.

- Compliance and governance: Integrated risk management includes governance structures and compliance measures to ensure that risk management processes are well-defined, monitored, and adhered to.

- Continuous improvement: Integrated risk management is an ongoing process. It involves continuous monitoring, assessment, and adjustment of risk management strategies in response to changing internal and external factors.

Overall, integrated risk management is a proactive and holistic approach that helps organizations navigate an increasingly complex and uncertain business environment while promoting resilience and sustainable growth.

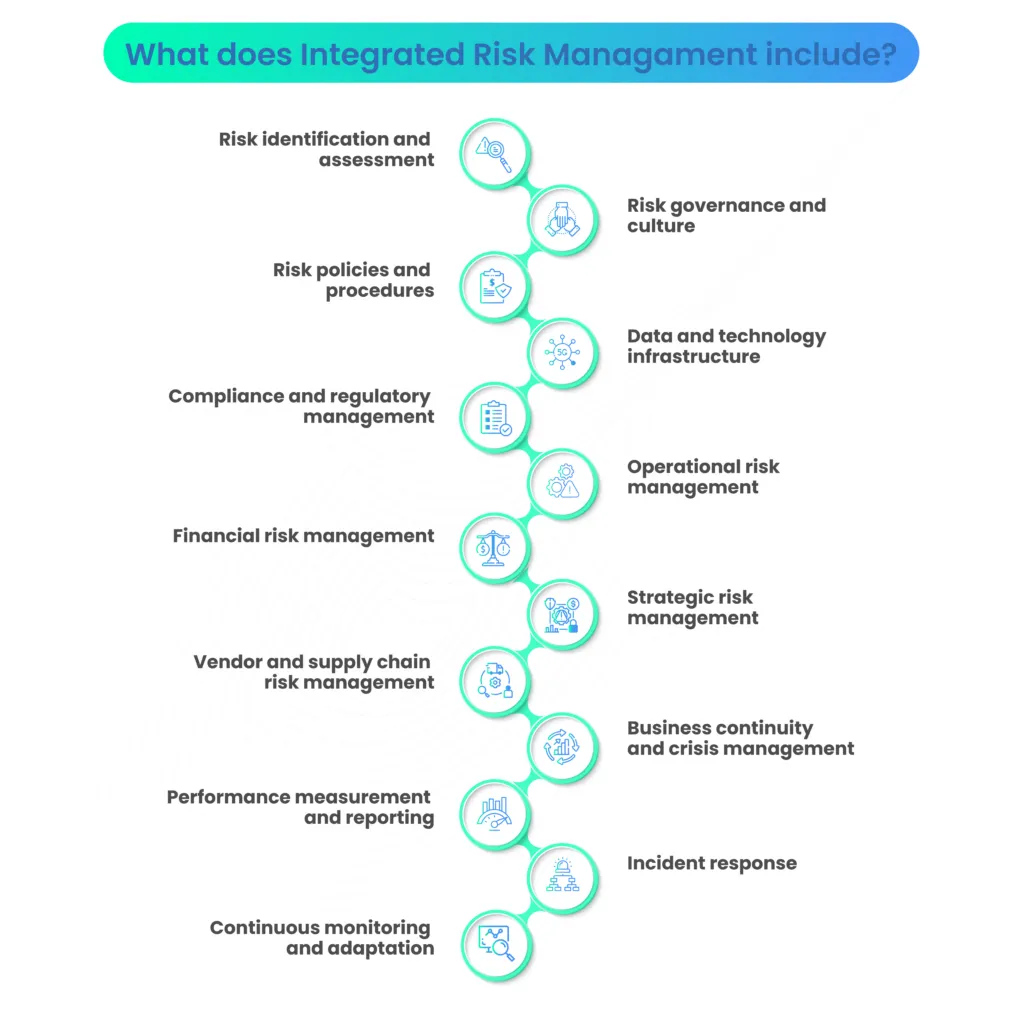

Key components of integrated risk management

IRM is a comprehensive approach to managing risks across an organization. It involves various components and practices aimed at identifying, assessing, and mitigating risks while aligning with business objectives. Here are the key components of integrated risk management:

1. Risk identification and assessment

The foundation of integrated risk management is the identification of risks across all aspects of the organization, including operational, financial, strategic, and compliance risks. Risks are assessed for their potential impact on the organization and the likelihood of occurrence.

2. Risk governance and culture

Effective integrated risk management requires a risk-aware culture throughout the organization. Governance structures, including the oversight of risk management by the board of directors and senior management, are essential components.

3. Risk policies and procedures

Establishing clear risk policies and procedures ensures that risk management practices are standardized and consistent. These policies define risk appetite, risk tolerance, and risk limits.

4. Data and technology infrastructure

IRM relies on data analytics and technology tools to collect, analyze, and report on risk-related information. A robust data and technology infrastructure is essential for effective automated risk management.

5. Compliance and regulatory management

Ensuring compliance with relevant laws and regulations is a key component of integrated risk management. Organizations must stay informed about changing regulations and adapt their risk management practices accordingly.

6. Operational risk management

Managing operational risks related to processes, systems, and human factors is a crucial element of integrated risk management. This includes identifying vulnerabilities and implementing controls to mitigate operational risks.

7. Financial risk management

Managing financial risks, such as market, credit, and liquidity risks, is essential for financial stability. Integrated risk management includes strategies to monitor and mitigate these financial risks.

8. Strategic risk management

Assessing and managing risks related to strategic decisions and business objectives is a critical component. Organizations must align risk management with strategic planning.

9. Vendor and supply chain risk management

Managing risks associated with third-party vendors and the supply chain is becoming increasingly important. Integrated risk management includes evaluating and mitigating risks posed by external parties.

10. Business continuity and crisis management

Preparing for and responding to crises is a key aspect of IRM. Business continuity plans and crisis management strategies are part of the integrated risk management framework.

11. Performance measurement and reporting

IRM involves the establishment of key performance indicators (KPIs) to measure the effectiveness of risk management efforts. Regular reporting to stakeholders, including senior management and the board, is crucial.

12. Incident response

Organizations should have well-defined incident response plans to address and mitigate risks when they materialize. Prompt and effective responses can limit the impact of adverse events.

13. Continuous monitoring and adaptation

Integrated risk management is an ongoing process that requires continuous monitoring of risks and adjustments to risk management strategies. Organizations must adapt to changing business environments and emerging risks.

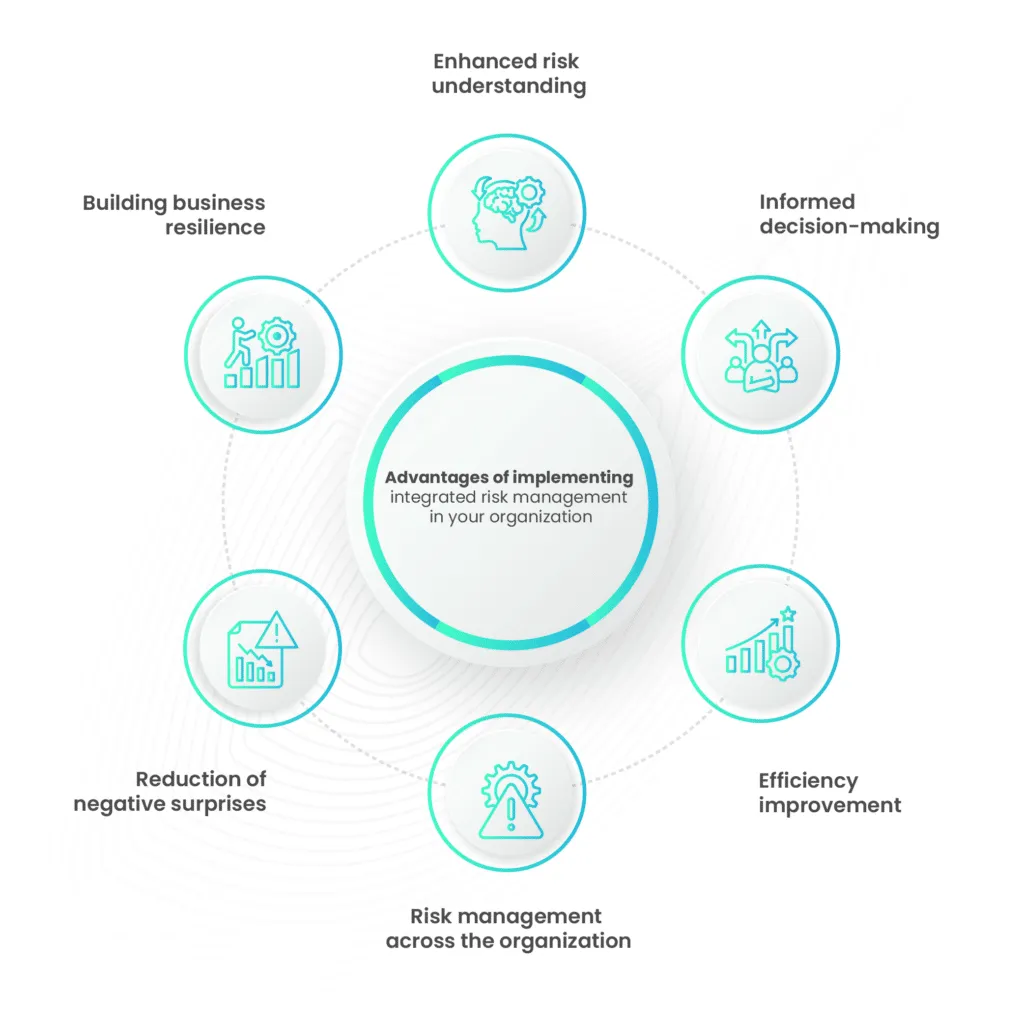

Benefits of implementing integrated risk management

The implementation of IRM offers several significant benefits to organizations. Here are some of the key advantages:

1. Enhanced risk understanding

Integrated risk management provides organizations with a comprehensive view of their risks across various domains, including operational, financial, compliance, and strategic. This deeper understanding allows for more informed decision-making and risk mitigation.

2. Informed decision-making

With IRM, organizations can make data-driven decisions based on a holistic assessment of risks. This supports more effective risk-based decision-making, reducing the likelihood of costly errors.

3. Efficiency improvement

The integrated risk management process helps identify opportunities to increase efficiency during risk identification, analysis, and assessment. This can lead to streamlined processes and resource optimization.

4. Risk management across the organization

IRM allows for a more comprehensive and entity-wide approach to risk management. It ensures that risks are managed consistently across all departments and business units, reducing gaps in risk oversight.

5. Reduction of negative surprises

By proactively identifying and managing risks, integrated risk management helps organizations reduce negative surprises. This minimizes the impact of unexpected events on business operations and performance.

6. Building business resilience

Business resilience is crucial for organizations in today's dynamic business landscape. It involves adapting and thriving amid disruptions. Its significance lies in ensuring survival, building customer trust, gaining a competitive edge, and addressing various threats, including natural disasters, cyberattacks, supply chain issues, health crises, and regulatory changes.

Risk management is key to bolstering business resilience, involving threat identification, impact assessment, risk mitigation, and continuous monitoring. Overall, business resilience is vital for navigating uncertainties effectively.

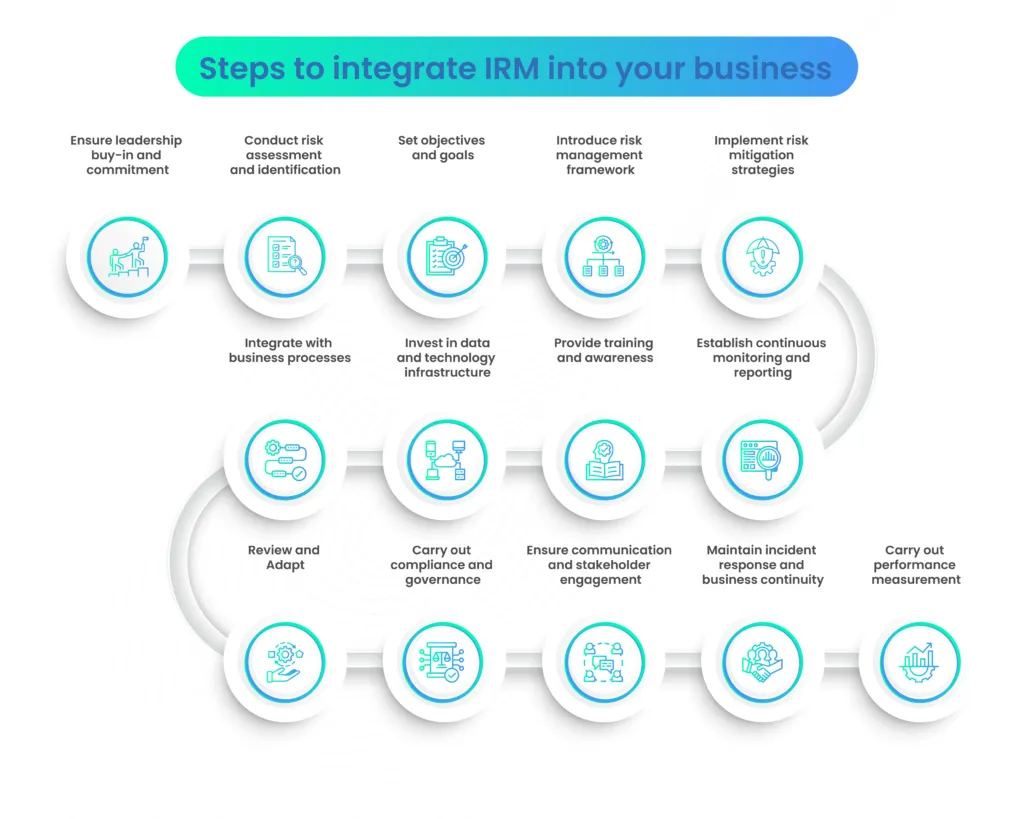

Implementing integrated risk management in your organization

Implementing Integrated Risk Management into your business involves a structured approach to effectively identify, assess, and mitigate risks while aligning with business objectives. Here are the key steps to integrate IRM into your organization:

Step 1: Ensure leadership buy-in and commitment

Secure support and commitment from top leadership to prioritize integrated risk management within the organization. Establish a dedicated risk management team or designate individuals responsible for IRM.

Step 2: Conduct risk assessment and identification

Conduct a comprehensive risk assessment to identify potential risks and vulnerabilities across all areas of the business. Categorize and prioritize risks based on their impact and likelihood.

Step 3: Set objectives and goals

Define clear objectives and goals for the integrated risk management program that align with the overall business strategy. Ensure that risk management objectives support business growth and sustainability.

Step 4: Introduce risk management framework

Establish a risk management framework that includes policies, procedures, and guidelines for risk identification, assessment, and mitigation. Define risk tolerance levels and thresholds for different types of risks.

Step 5: Implement risk mitigation strategies

Develop risk mitigation strategies and action plans for identified risks. Assign responsibilities for implementing and monitoring these strategies.

Step 6: Integrate with business processes

Embed risk management into day-to-day business processes and decision-making. Ensure that risk considerations are part of project management, product development, and operational activities.

Step 7: Invest in data and technology infrastructure

Invest in the necessary data and technology infrastructure to support integrated risk management efforts. Utilize integrated risk management software and tools for data analysis, reporting, and monitoring.

Step 8: Provide training and awareness

Provide training and awareness programs for employees at all levels to educate them about integrated risk management principles and their roles in risk management. Foster a risk-aware culture within the organization.

Step 9: Establish continuous monitoring and reporting

Implement continuous monitoring mechanisms to track risks and their status. Establish a reporting system that communicates risk-related information to relevant stakeholders.

Step 10: Review and Adapt

Regularly review and update the risk management framework and strategies to adapt to changing business conditions and emerging risks. Conduct periodic risk assessments to ensure that new risks are identified and addressed.

Step 11: Carry out compliance and governance

Ensure that the integrated risk management program complies with relevant industry regulations and standards. Incorporate governance principles into risk management to enhance transparency and accountability.

Step 12: Ensure communication and stakeholder engagement

Maintain open communication channels with internal and external stakeholders, including customers, suppliers, and regulatory authorities. Engage with stakeholders to gather insights and feedback on risk management practices.

Step 13: Maintain incident response and business continuity

Develop an incident response plan to address unforeseen events and crises. Implement business continuity measures to ensure that critical operations can continue in the event of a disruption.

Step 14: Carry out performance measurement

Establish KPIs to assess the effectiveness of the integrated risk management program. Regularly evaluate the performance of risk management activities and make improvements as needed.

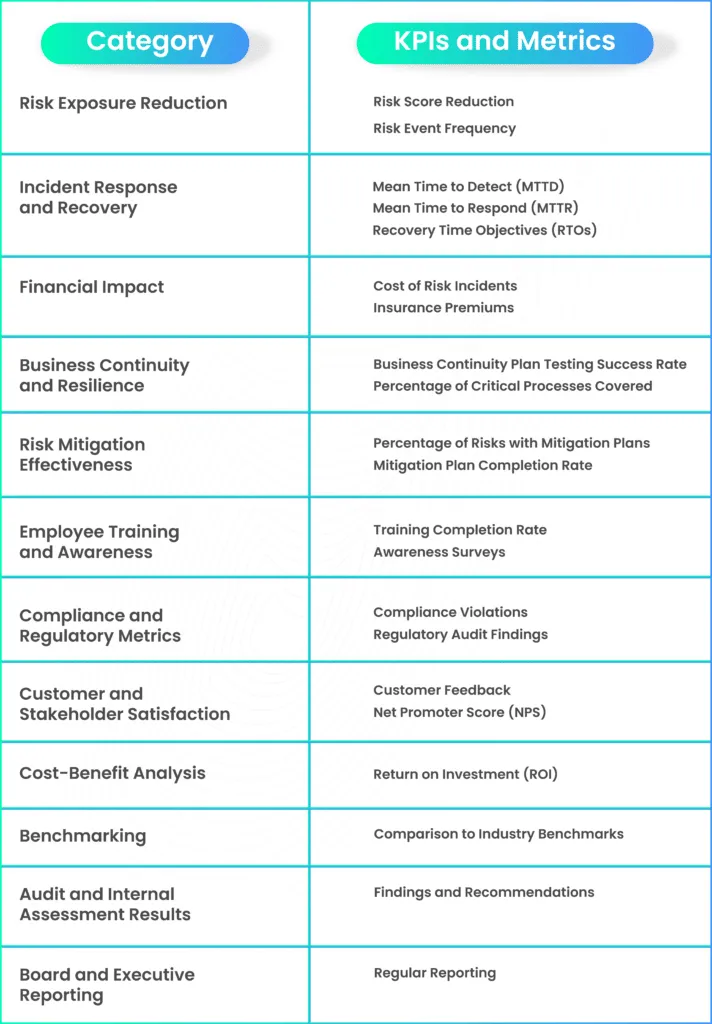

Measuring the success of integrated risk management in business resilience

KPIs and metrics are essential for evaluating the effectiveness of integrated risk management within an organization. These metrics help you track progress, identify areas of improvement, and ensure that your IRM program is aligned with your business objectives and risk management goals. Here are some KPIs and metrics for evaluating IRM effectiveness:

The long-term impact of integrated risk management on business resilience

IRM has a profound and enduring impact on business resilience. Over time, it fosters a culture of risk awareness and proactive risk management within the organization, empowering employees to identify and mitigate risks effectively. This long-term commitment to integrated risk management leads to the development of robust risk mitigation strategies, continuously refined through experience and lessons learned.

Integrated risk management also ensures the creation of adaptable business continuity and disaster recovery plans, guaranteeing the uninterrupted continuation of critical operations during disruptions. These proactive measures result in cost savings and financial stability as the organization becomes better equipped to reduce the financial impact of incidents over time.

Furthermore, organizations with mature integrated risk management programs gain a competitive edge, as they are better positioned to handle risks and are favored among stakeholders. IRM also aids in sustaining regulatory compliance, reducing the risk of penalties and reputational damage.

Effective integrated risk management contributes to maintaining a positive reputation by minimizing the negative impact of disruptions on stakeholders' trust and perception. This, in turn, builds trust and confidence among customers, investors, and employees. IRM encourages innovation and adaptability, allowing organizations to explore new opportunities and markets with confidence.

Moreover, integrated risk management enhances an organization's sustainability by enabling it to better withstand economic downturns, natural disasters, and crises. It fosters a culture of continuous improvement, using past incidents to enhance risk management strategies. Lastly, it provides leaders with valuable insights into the risk landscape over time, enabling data-driven and informed strategic decisions.

In summary, the long-term impact of integrated risk management encompasses cultural shifts, improved risk management, cost savings, competitiveness, adaptability, and the ability to thrive in a dynamic business environment. It ensures an organization's resilience in the face of uncertainties, making it a crucial component of long-term business success.

Conclusion: Embracing integrated risk management for a resilient future

In today's dynamic business world, Integrated Risk Management (IRM) has emerged as a vital strategy for fostering resilience. By seamlessly incorporating risk management into an organization's core operations, integrated risk management empowers proactive risk identification and mitigation.

IRM principles encompass a holistic view of risks, aligning them with business objectives and promoting data-driven decision-making. Robust governance structures, clear policies, and compliance measures ensure a solid risk management foundation.

Integrated risk management not only guards against disruptions like cyber threats and supply chain issues but also enhances efficiency and builds stakeholder trust. Its implementation involves leadership commitment, continuous monitoring, and adaptation to changing circumstances.

Ultimately, integrated risk management is the key to safeguarding assets, seizing opportunities, and ensuring long-term success in an unpredictable business landscape. It transforms businesses into resilient entities that can navigate challenges and thrive in a rapidly evolving environment.

Ready to fortify your business resilience with Integrated Risk Management (IRM)? Take the first step towards a more secure and adaptable future. Contact us now to learn how Scrut can help you implement IRM effectively!

FAQs

1. What is Integrated Risk Management (IRM)?

Integrated Risk Management (IRM) is a comprehensive approach that organizations adopt to identify, assess, manage, and mitigate risks across various facets of their operations. It involves integrating risk management procedures into the core of the organization's decision-making processes, strategies, and activities.

2. Why is IRM important in today's business landscape?

IRM is crucial because businesses face an array of risks, from cybersecurity threats to global economic fluctuations. IRM helps organizations navigate these uncertainties by proactively identifying and addressing risks, aligning risk management with business strategy, and promoting a culture of resilience.

3. How can I measure the success of IRM in my organization?

Success in IRM can be measured using key performance indicators (KPIs) and metrics. These may include reductions in risk exposure, incident response and recovery times, financial impact of risks, business continuity plan testing success rates, and more. Regular audits, internal assessments, and stakeholder feedback also provide insights into the effectiveness of IRM.