Reducing compliance expenses with AI

Navigating the complex compliance arena has long been a formidable challenge for organizations across industries.

The stringent regulatory requirements, coupled with the potential financial implications of non-compliance, pose a continuous hurdle and demand significant resources, both in terms of time and finances.

Artificial Intelligence (AI) serves as a catalyst for change, offering innovative solutions to reduce compliance costs. By automating processes, enhancing efficiency, and providing predictive insights, AI alleviates financial burdens and streamlines operations. Strategic AI integration can lead to substantial cost reductions in compliance processes.

In this blog, we’ll explore how your organization can go about reducing compliance expenses with AI.

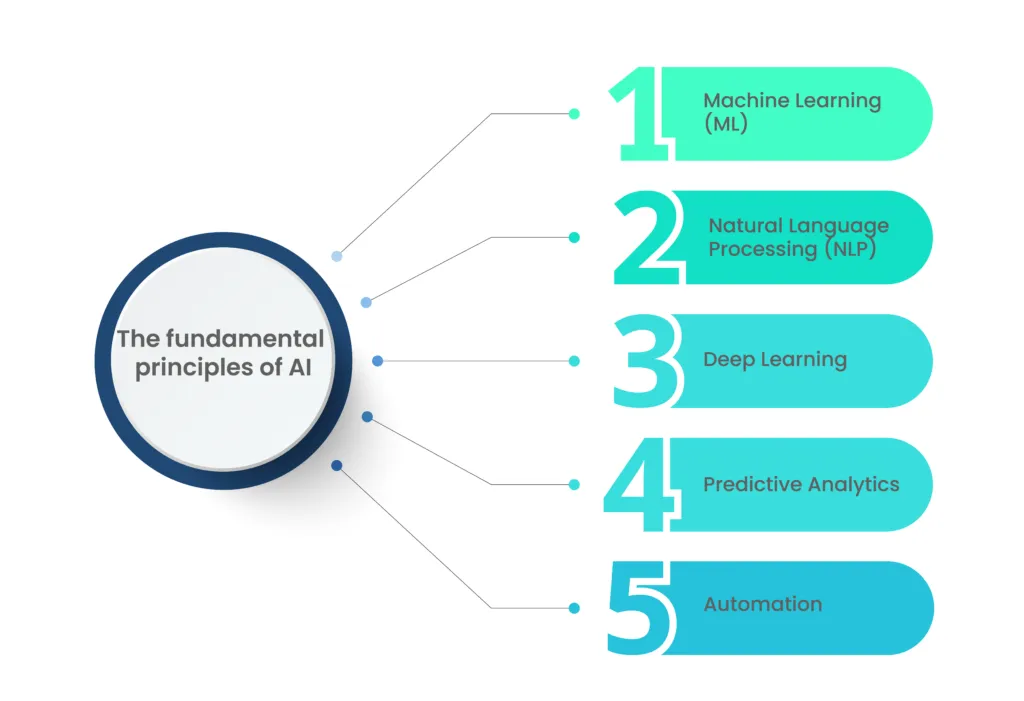

Fundamental principles of AI that help with compliance costs

AI refers to the development of computer systems that can perform tasks that typically require human intelligence, thereby reducing compliance costs.

In the context of compliance, AI integration involves incorporating these intelligent systems into various aspects of regulatory adherence.

1. Machine Learning (ML)

Machine Learning is a subset of AI that focuses on enabling computers to learn from data and improve their performance without being explicitly programmed.

ML algorithms can analyze historical compliance data to identify patterns and trends, allowing systems to make predictions and decisions without explicit programming.

In compliance, ML can be utilized for predictive analytics in risk assessments, anomaly detection, and decision-making processes. This not only enhances the accuracy and efficiency of compliance processes but also contributes to a significant reduction in associated costs.

2. Natural Language Processing (NLP)

Natural Language Processing is a branch of AI that enables computers to understand, interpret, and generate human language in a way that is both meaningful and contextually relevant.

NLP is crucial for processing and understanding the vast amounts of unstructured data present in compliance documents, regulations, and legal texts. It allows AI systems to extract insights, identify key compliance requirements, and facilitate more efficient document review processes, contributing to a notable reduction in compliance costs.

3. Deep Learning

Deep Learning is a subset of ML that involves neural networks with multiple layers (deep neural networks) to model and process complex patterns in large datasets.

Deep Learning enhances pattern recognition and can be applied to analyze intricate compliance-related data. It’s particularly effective in tasks such as fraud detection, where it can identify subtle anomalies in data that may indicate potential compliance issues.

By enhancing the efficiency of identifying potential compliance issues, Deep Learning ultimately contributes to cost reduction in the compliance process.

4. Predictive Analytics

Predictive analytics involves using statistical algorithms and machine learning techniques to identify the likelihood of future outcomes based on historical data.

Predictive analytics in AI can forecast potential compliance risks by analyzing past patterns. For instance, it can predict the likelihood of non-compliance based on historical data, helping organizations proactively address and mitigate risks.

This proactive approach not only enhances compliance effectiveness but also contributes to a reduction in overall compliance costs.

Siemens utilized AI in its manufacturing processes to optimize production efficiency. AI-driven predictive maintenance reduced downtime and equipment failures, resulting in substantial cost savings by avoiding unplanned maintenance and optimizing resource utilization.

5. Automation

Automation involves using AI to perform tasks without direct human intervention. Automation can streamline routine compliance tasks, such as data entry, monitoring, and reporting.

By automating these processes, organizations can reduce manual effort, minimize errors, reduce costs, and ensure that compliance tasks are consistently executed.

Applications of AI in compliance and its impact on costs

Utilizing AI in compliance offers a multifaceted and impactful approach that not only improves processes but also achieves cost reduction. From automating mundane tasks to scrutinizing extensive datasets for patterns and anomalies, AI has become an invaluable tool in bolstering the efficiency of compliance operations.

1. Risk assessments

AI plays a pivotal role in automating and enhancing risk assessments within compliance. Machine learning algorithms can analyze historical data to identify patterns and predict potential risks.

This enables organizations to conduct more thorough and precise risk assessments, evaluating both internal and external factors that may impact compliance. By streamlining these assessments, AI contributes directly to cost reductions in the overall compliance framework.

JPMorgan Chase utilizes AI-driven risk assessment tools to analyze vast datasets and identify potential compliance risks. The system helps in predicting emerging risks, allowing the company to implement proactive measures and enhance its overall risk management strategy.

2. Monitoring

AI in compliance delivers cost-effective solutions through continuous real-time monitoring. Automated systems swiftly analyze transactions and data to detect anomalies, providing immediate insights into potential compliance issues. This proactive approach streamlines processes, contributing directly to cost reductions in compliance operations.

HSBC employs AI-powered monitoring systems to scrutinize financial transactions and detect unusual patterns indicative of potential money laundering or fraud. This proactive monitoring helps HSBC maintain compliance with stringent regulations in the financial sector.

3. Reporting

AI facilitates the automation of reporting processes by extracting, analyzing, and summarizing relevant data. This not only saves time and costs but also ensures accuracy and consistency in compliance reporting. Natural Language Processing (NLP) can be employed to generate human-readable reports from complex datasets.

Microsoft utilizes AI algorithms to automate the generation of compliance reports. These systems analyze data from various sources, extract key information, and generate comprehensive reports that assist Microsoft in meeting regulatory reporting requirements efficiently.

Benefits of AI in compliance from a cost-reduction perspective

One of the primary goals of AI integration in compliance is to enhance overall efficiency. By automating repetitive tasks, reducing manual effort, and improving the accuracy of processes, AI becomes a powerful ally in achieving efficiency gains and cost savings.

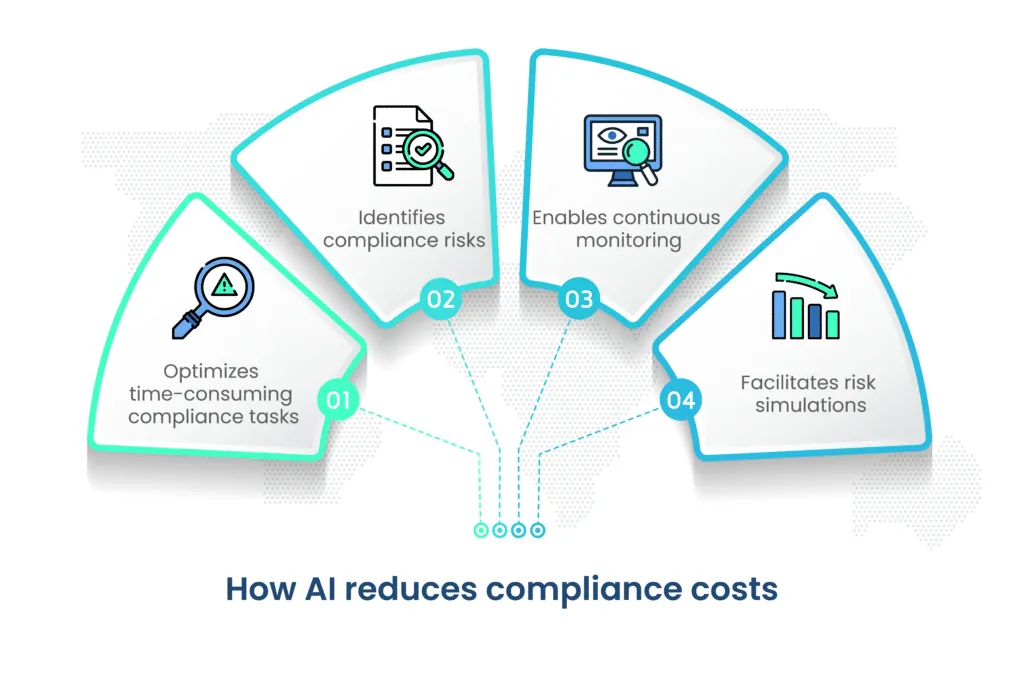

1. Optimizes time-consuming compliance tasks

- Automating manual processes: AI streamlines manual and repetitive compliance tasks like data entry and document review, reducing the time and effort required for routine activities. This optimization allows resources to be used more strategically, contributing to cost-effective operations.

- Accelerates data analysis and extraction: AI-powered tools swiftly analyze large datasets, expediting the data review process while ensuring accuracy. This not only saves time but also mitigates risks associated with manual data handling.

2. Identifies compliance risks

AI proactively identifies potential compliance risks using predictive analytics. By analyzing historical data patterns, AI systems predict and highlight areas that may pose compliance challenges in the future. This early identification helps in addressing issues before they escalate, reducing the potential costs associated with non-compliance.

3. Enables continuous monitoring

AI facilitates continuous monitoring of data sources, transactions, and communications, swiftly detecting anomalies or deviations in real time. This proactive approach reduces the likelihood of non-compliance, minimizing associated risks and potential costs.

4. Facilitates risk simulations

AI supports the creation of risk scenarios and simulations, allowing organizations to assess the potential impact of various compliance risks. By modeling different scenarios, organizations can develop proactive strategies to mitigate risks, enhancing overall risk management capabilities and reducing potential costs associated with unforeseen compliance challenges.

Cost-effective transformation: incorporating AI into risk assessments

Traditional risk assessment methodologies are being transformed by the integration of AI in risk and compliance. They mark a significant shift toward more efficient and cost-effective risk and compliance practices.

AI’s capabilities in processing vast amounts of data, identifying patterns, and predicting potential risks bring a new level of efficiency and accuracy to risk assessment processes.

1. Predictive risk modeling

AI algorithms excel in predictive analytics, analyzing historical data to identify patterns and trends. This allows organizations to create predictive risk models, foreseeing potential compliance risks before they materialize.

The proactive nature of AI-driven risk assessments enables organizations to allocate resources strategically and implement preventive measures, contributing directly to cost reduction by addressing potential risks at an early stage.

JPMorgan Chase utilizes AI for predictive risk modeling. The AI system analyzes historical data to identify patterns indicative of potential compliance risks, enabling the bank to proactively address emerging challenges and enhance its overall risk management strategy.

2. Automation of risk scenarios for cost-efficiency

AI enables the automation of risk scenario modeling, allowing organizations to simulate various risk scenarios. This not only enhances the accuracy of risk assessments but also provides a dynamic view of potential compliance risks under different circumstances.

The ability to automate and iterate risk scenarios not only enhances risk management strategies but also contributes directly to cost reduction. By streamlining the modeling process, organizations can achieve greater efficiency in their risk management practices, optimizing resource allocation.

3. Continuous monitoring and anomaly detection for immediate cost savings

AI systems provide continuous monitoring of data, transactions, and communications. Through real-time analysis, anomalies or deviations from expected patterns are swiftly identified.

This real-time monitoring capability is crucial for detecting emerging risks promptly, allowing organizations to take immediate action and prevent potential compliance issues from escalating. This minimizes the potential financial impact of non-compliance.

HSBC employs AI for continuous monitoring and anomaly detection. The AI-powered system scrutinizes financial transactions to detect unusual patterns, aiding in the early identification of potential money laundering or fraud risks. This proactive monitoring contributes to HSBC’s robust compliance measures.

AI for cost-efficient regulatory compliance

The dynamic nature of regulatory landscapes demands a proactive approach to compliance, and AI emerges as a strategic ally in navigating and adapting to regulatory changes, providing significant cost-reduction benefits.

IBM Watson is widely used for regulatory compliance across industries. Its AI capabilities enable organizations to analyze and interpret complex regulatory texts, ensuring a comprehensive understanding of compliance requirements and facilitating more accurate risk assessments.

1. Real-time monitoring of regulatory updates

AI enables organizations to stay abreast of regulatory changes in real time. By continuously monitoring official channels, regulatory websites, and industry publications, AI systems can swiftly identify and analyze updates.

This real-time awareness ensures that organizations are well informed about changes that may impact their compliance obligations, reducing the likelihood of non-compliance and associated costs.

UBS, a global financial services company, utilizes AI for regulatory reporting. The system automates the extraction and analysis of relevant data from diverse sources, ensuring accurate and timely reporting to regulatory authorities. By leveraging AI in regulatory reporting, UBS has improved the efficiency of its compliance processes, reduced manual errors, and enhanced overall reporting accuracy.

2. Automated impact assessments

When regulatory changes occur, AI can conduct automated impact assessments. By analyzing the implications of new regulations on existing policies and procedures, organizations can efficiently identify areas that require adjustment.

This proactive analysis streamlines the adaptation process, reducing the time and effort needed to align with updated compliance requirements. The efficiency gained translates directly into cost savings for organizations.

3. Predictive analytics for future compliance trends

AI’s predictive analytics capabilities extend beyond current regulatory changes. By analyzing historical data and industry trends, AI systems can predict future compliance trends.

This foresight allows organizations to proactively prepare for upcoming regulatory shifts, positioning them ahead of the curve in compliance readiness. By strategically planning for future compliance requirements, organizations can reduce the financial impact associated with abrupt changes and avoid reactive, costly adjustments.

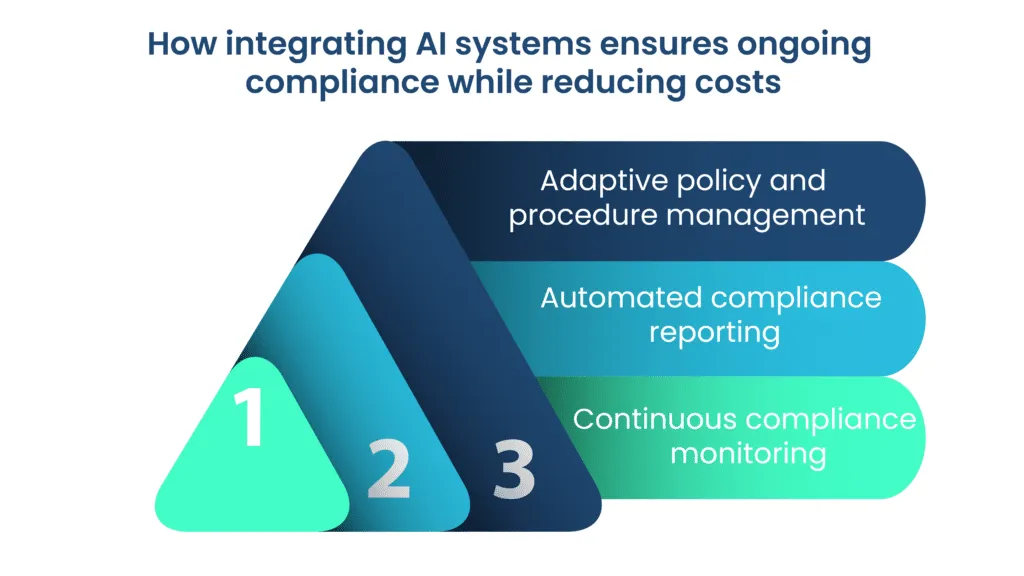

How AI systems ensure ongoing compliance while reducing costs

The integration of AI extends beyond regulatory adaptation, focusing on ongoing compliance with continuous support and monitoring, leading to significant cost reduction.

1. Continuous compliance monitoring for timely risk mitigation

AI systems offer continuous monitoring of compliance-related activities. By analyzing transactions, communications, and other relevant data in real time, AI identifies potential compliance risks as they emerge.

This continuous monitoring is instrumental in preventing non-compliance issues from escalating and ensuring ongoing adherence to regulatory requirements. By addressing issues promptly, organizations minimize potential financial impacts and reduce the overall cost of compliance.

2. Automated compliance reporting for efficient resource utilization

AI streamlines the process of compliance reporting. Automated systems can extract, analyze, and summarize relevant data for reporting purposes. Efficient reporting processes contribute directly to cost reduction by allowing organizations to meet deadlines with increased efficiency.

3. Adaptive policy and procedure management

AI contributes to adaptive policy and procedure management. As regulatory requirements evolve, AI can automatically update and adjust organizational policies and procedures.

This adaptability ensures that organizations maintain compliance not just in response to current regulations but also in anticipation of future changes. By staying ahead of regulatory shifts, organizations reduce the need for reactive, costly adjustments, thereby achieving long-term cost reduction in compliance management.

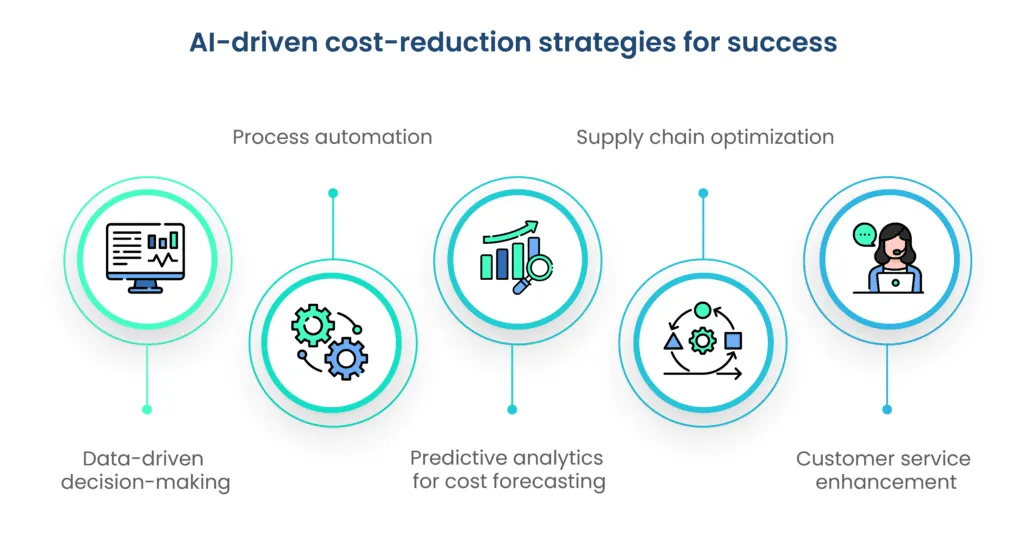

AI-driven cost-reduction strategies for success

1. Data-driven decision-making

Successful companies leverage AI for data-driven decision-making. By analyzing vast datasets, organizations gain insights that inform strategic decisions, leading to more efficient resource allocation and cost-effective operations.

2. Process automation

Automation of routine tasks is a key AI-driven strategy. Companies achieve cost reductions by deploying AI to automate manual and repetitive processes, freeing up human resources for more strategic and value-added activities.

3. Predictive analytics for cost forecasting

AI-driven predictive analytics enables companies to forecast costs accurately. By analyzing historical data and identifying patterns, organizations can predict future costs, allowing for proactive budgeting and resource allocation.

4. Supply chain optimization

AI plays a crucial role in optimizing supply chain processes. Companies use AI to enhance demand forecasting, inventory management, and logistics, resulting in streamlined operations and reduced costs associated with excess inventory or disruptions in the supply chain.

Walmart deployed AI for demand forecasting and inventory management. By accurately predicting customer demand and optimizing inventory levels, Walmart achieved notable cost reductions through reduced overstock, minimized stockouts, and improved overall supply chain efficiency.

5. Customer service enhancement

AI-driven improvements in customer service lead to cost reductions. Chatbots and virtual assistants powered by AI handle routine customer inquiries, reducing the need for extensive human customer support, and improving overall customer service efficiency.

Bank of America implemented AI for customer service and support, automating routine inquiries and streamlining communication processes. This not only improved customer satisfaction but also led to significant cost savings by reducing the need for extensive human intervention in customer interactions.

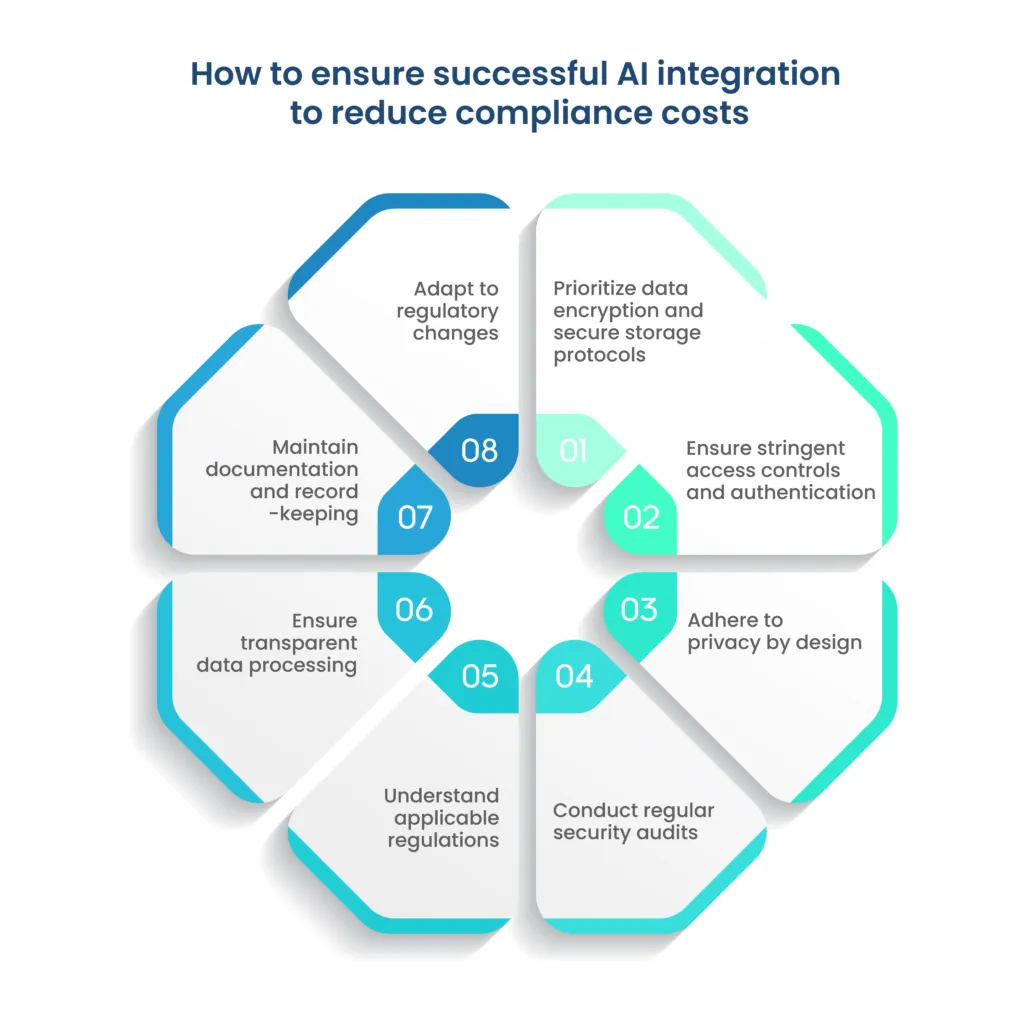

Considerations for successful AI integration to reduce compliance costs

Successfully integrating AI to reduce compliance costs requires a strategic approach that addresses data security, privacy concerns, and ensures ongoing regulatory compliance.

These considerations play a crucial role in fostering trust among stakeholders and effectively mitigating legal and operational risks.

1. Prioritize data encryption and secure storage protocols

When integrating AI, organizations must prioritize data security. Implementing robust encryption methods and secure storage protocols ensures that sensitive information is protected from unauthorized access. This is especially crucial in compliance-heavy industries like finance and healthcare.

2. Ensure stringent access controls and authentication

Limiting access to AI systems through stringent access controls and authentication mechanisms enhances data security. By assigning access privileges based on roles and responsibilities, organizations can mitigate the risk of unauthorized individuals gaining access to sensitive data.

3. Adhere to privacy by design

Adhering to the principle of privacy by design involves incorporating privacy considerations throughout the AI integration process. This proactive approach ensures that privacy is not an afterthought but an integral part of the system, from data collection to processing and storage.

4. Conduct regular security audits

Conducting regular security audits and assessments helps organizations identify vulnerabilities and weaknesses in their AI systems. By staying proactive in identifying and addressing potential security threats, organizations can maintain a robust defense against evolving cybersecurity risks.

5. Understand applicable regulations

Different industries and regions have specific regulations governing data and AI usage. It’s crucial for organizations to have a thorough understanding of the applicable regulatory landscape, including data protection laws, industry standards, and any specific requirements related to AI systems.

6. Ensure transparent data processing

Ensuring transparency in data processing is essential for regulatory compliance. Organizations should clearly communicate how data is collected, processed, and utilized by AI systems. This transparency builds trust with stakeholders and helps meet regulatory expectations regarding data handling.

7. Maintain documentation and record-keeping

Maintaining comprehensive documentation of AI processes and activities is vital for compliance. This includes records of data processing activities, security measures, and any changes made to the AI system. Such documentation serves as evidence of compliance during regulatory audits.

8. Adapt to regulatory changes

The regulatory landscape is dynamic, and AI systems must be adaptable to changes. Organizations should have mechanisms in place to monitor regulatory updates and swiftly adapt their AI systems to ensure ongoing compliance with evolving requirements.

- Explainable AI (XAI): Ensuring transparency in AI decision-making, XAI is pivotal for compliance, fostering trust and accountability by allowing professionals to interpret and explain AI-driven decisions.

- AI-enabled regulatory sandboxes: These controlled testing environments integrate AI, enabling organizations to experiment with compliance-focused AI applications within supportive regulatory frameworks, promoting innovation.

- Blockchain and smart contracts in compliance: The convergence of AI and blockchain automates and enforces compliance-related agreements through AI-powered smart contracts, enhancing efficiency and security, especially in sectors dependent on contractual obligations.

- AI-driven regulatory intelligence platforms: Future AI systems may evolve into autonomous regulatory intelligence platforms, providing real-time updates and actionable insights by scanning, interpreting, and adapting to global regulatory changes for continuous compliance.

- Enhanced Natural Language Processing (NLP): Advancements in NLP could revolutionize how compliance professionals interact with AI, enabling nuanced communication and a deeper understanding of complex regulatory language.

- Cross-industry collaboration: Future AI developments may encourage increased collaboration among industries, leveraging AI systems to facilitate secure cross-industry information exchange for improved compliance strategies.

- AI for predictive regulatory compliance: AI’s predictive capabilities may expand to foresee regulatory changes through advanced analytics and machine learning, allowing organizations to proactively adapt compliance strategies by analyzing global trends, political landscapes, and emerging technologies.

Wrapping up

In the dynamic realm of compliance, AI emerges as a transformative ally, revolutionizing how organizations navigate regulations. From robust data security to ongoing compliance assurance, successful AI integration is pivotal.

Industry success stories underscore tangible benefits, showcasing cost reductions and strategic wins. Looking ahead, emerging trends like Explainable AI and regulatory sandboxes hint at a future where transparency and innovation prevail.

As organizations embrace these advancements, the synergy of AI and compliance not only streamlines processes but fortifies trust, efficiency, and future readiness.

Find out how Scrut can help you reduce compliance costs with AI. Schedule a demo today to learn more.

Frequently Asked Questions

1. How can AI technologies specifically help in reducing compliance costs?

AI technologies automate routine tasks, analyze large datasets for patterns, and provide predictive insights, significantly reducing the manual effort and time required for compliance processes. This efficiency translates into cost savings by streamlining operations.

2. What are some key areas within compliance processes where AI implementations offer the most significant cost savings?

AI excels in automating data analysis, risk assessments, monitoring, and reporting. These areas, when optimized through AI, not only enhance accuracy and effectiveness but also lead to substantial reductions in operational costs associated with compliance tasks.

3. Are there specific industries that have seen notable success in reducing compliance expenses through AI integration?

Industries such as finance, healthcare, and manufacturing have experienced notable success in reducing compliance expenses with AI. These sectors deal with complex regulations and large volumes of data, making AI particularly effective in enhancing efficiency and reducing costs.

4. How does the use of AI in compliance align with regulatory requirements and standards?

AI in compliance ensures a proactive approach to meeting regulatory requirements. By continuously monitoring and adapting to changes in regulations, AI systems help organizations maintain compliance more effectively, thereby avoiding costly penalties and legal issues.

5. What considerations should organizations keep in mind when adopting AI solutions to ensure cost reduction without compromising compliance effectiveness?

Organizations should prioritize AI solutions that align with their specific compliance needs, ensure data security and privacy, and facilitate transparency. Regular audits and assessments are crucial to guaranteeing that AI systems remain compliant with evolving regulations, mitigating any risks associated with non-compliance.